Encompass Health (EHC)·Q4 2025 Earnings Summary

Encompass Health Delivers 9th Straight Beat as Adjusted EPS Surges 25% YoY

February 6, 2026 · by Fintool AI Agent

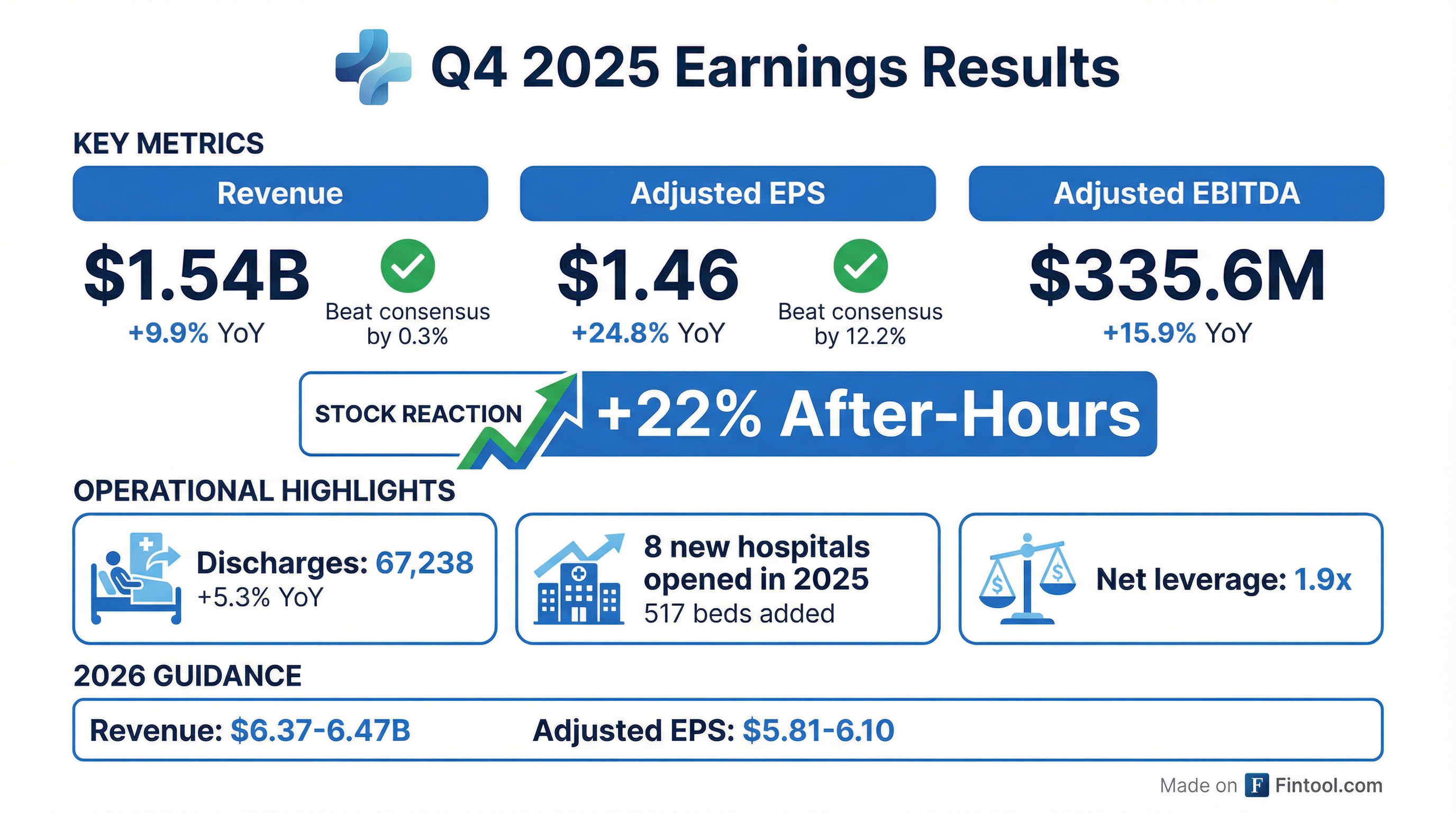

Encompass Health (NYSE: EHC), the nation's largest inpatient rehabilitation hospital operator, reported Q4 2025 results that extended its earnings beat streak to nine consecutive quarters. Adjusted EPS of $1.46 crushed consensus by 12.3%, while revenue rose 9.9% YoY to $1.54B on continued volume growth and pricing tailwinds. The stock surged 11.2% to $110.72 following the earnings call, as investors digested strong operating leverage, a new small-format hospital growth strategy, and management's aggressive stance on Medicare Advantage denials.

Did Encompass Health Beat Earnings?

Yes — and decisively on the bottom line. EHC delivered a triple beat across revenue, EPS, and EBITDA:

The EPS beat was driven by strong operating leverage, with Adjusted EBITDA margin expanding to 21.7% from 20.6% a year ago. Labor costs as a percentage of revenue improved 200 bps to 51.9% from 53.9% in Q4 2024, reflecting better staffing efficiency and reduced reliance on contract labor.

Beat Streak: 9 Quarters and Counting

EHC has beaten EPS estimates in every quarter since Q4 2023:

*Values retrieved from S&P Global

What Drove the Q4 2025 Beat?

Volume Growth Remains Strong

Discharges rose 5.3% YoY to 67,238 patients, driven by both new hospital openings and same-store performance:

The combination of 4.1% pricing improvement and 5.3% volume growth drove the near-10% revenue increase. Pricing benefited from Medicare rate increases and improved managed care contract negotiations.

Q4 2025 Discharge Growth by Diagnosis Category :

Brain injury — notably not a TEAM-impacted category — was the largest mix mover, up 40 bps to become the third largest discharge RIC category.

Labor Efficiency Improves

Salaries and benefits expense fell to 51.9% of revenue from 53.9% a year ago — a 200 bps improvement that flowed directly to margins.

Key labor metrics:

- Internal FTEs: 29,236 (+3.7% YoY)

- Contract Labor FTEs: 313 (-20.6% YoY)

- EPOB (Employees per Occupied Bed): 3.38 vs 3.42 in Q4 2024

The reduction in contract labor usage and improvement in employees per occupied bed reflects easing labor market conditions and successful internal hiring.

COO Pat Darcy on hiring: "Our centralized talent acquisition team continues to do a tremendous job. We added, from a same-store perspective, 300 net RNs in 2025, and that brings our four-year total up to around 1,700."

Clinical ladders driving retention: Nursing participation in clinical ladder programs reached 32%, therapists 36%, and nurse techs 47%. Clinicians on ladders have turnover about one-third of non-laddered employees.

How Did the Stock React?

EHC shares surged 11.2% to $110.72 by the close of February 6, 2026, following the earnings call. The stock opened at $115 — a gap up of 15.5% from the prior close — before settling lower as the day progressed.

Key Price Levels:

- Pre-earnings close (Feb 4): $95.66

- Post-earnings day 1 (Feb 5): $99.56 (+4.1%)

- Post-call close (Feb 6): $110.72 (+11.2% vs Feb 5)

- 52-week high: $127.99

- 52-week low: $92.53

- 50-day average: $105.14

- 200-day average: $115.52

The two-day rally of 15.7% reflects investor confidence in management's regulatory navigation and continued operating leverage. The stock is now 13% below its 52-week high.

What Did Management Guide?

2026 Guidance: In Line with Street Expectations

The 2026 guidance midpoints imply:

- Revenue growth: ~8% YoY

- Adj EBITDA growth: ~7% YoY

- Adj EPS growth: ~9% YoY

Key 2026 Guidance Assumptions

Pricing :

- Medicare pricing increase: ~3.0%

- Managed Care pricing increase: 2.0%-3.0%

- Bad debt reserves: 2.0%-2.5% of revenue

Labor :

- SWB per FTE increase: 3.0%-3.5%

Capacity :

- 8 new hospitals with 389 beds

- ~175 beds added to existing hospitals

- Pre-opening and ramp-up costs: $18-22M

Corporate :

- Tax rate: ~26%

- Diluted share count: ~102M shares

What Changed From Last Quarter?

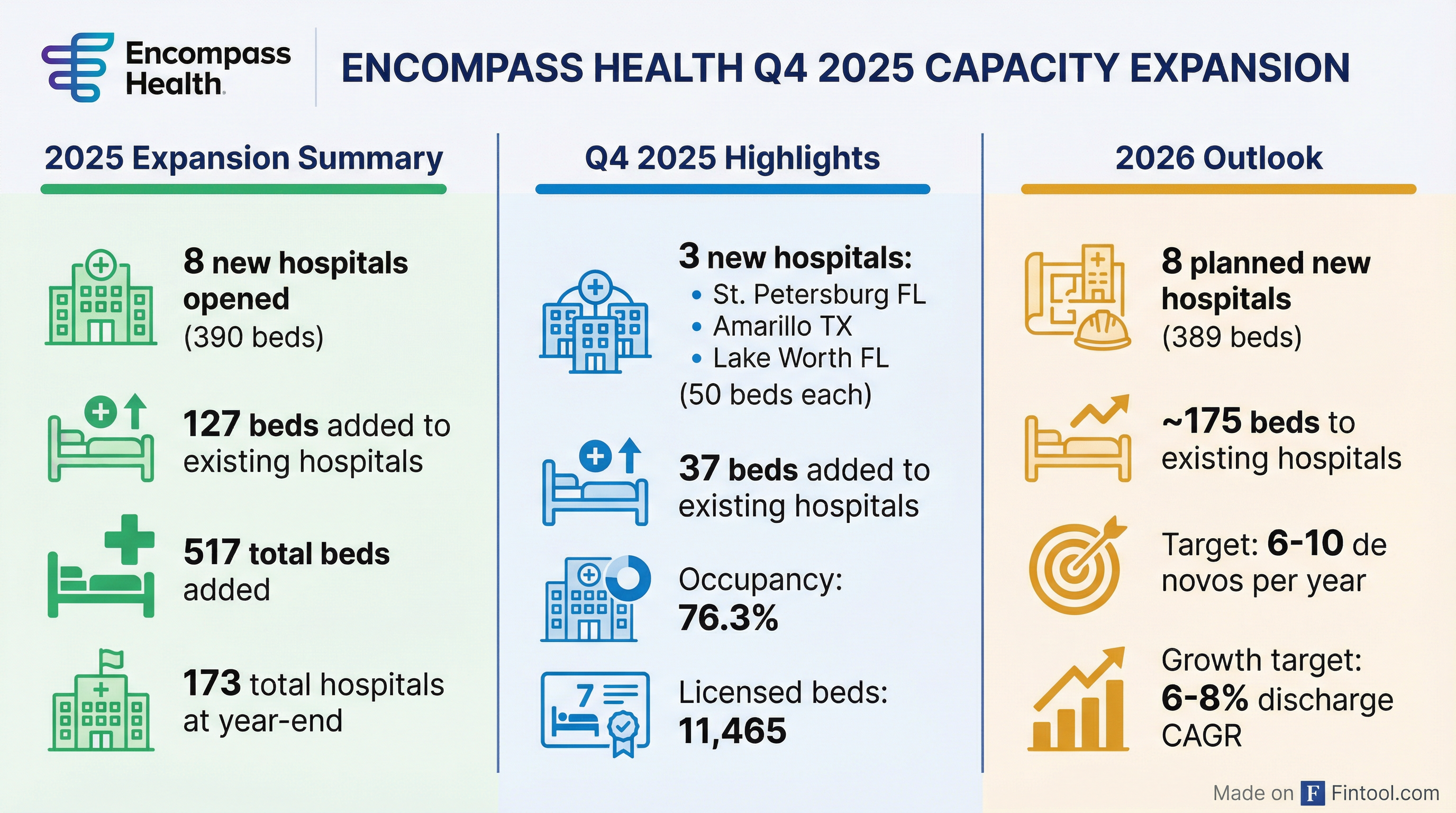

Capacity Expansion Continues at Full Speed

EHC opened 3 new hospitals in Q4 (150 beds) and added 37 beds to existing facilities, bringing full-year 2025 totals to 8 new hospitals (390 beds) plus 127 beds added.

Q4 2025 Hospital Openings :

- St. Petersburg, FL (50 beds)

- Amarillo, TX (50 beds, joint venture)

- Lake Worth, FL (50 beds)

2026 Pipeline :

- Q1: Irmo, SC (49 beds)

- Q2: Concordville, PA (50 beds), Loganville, GA (40 beds, JV)

- Q3: Norristown, PA (50 beds)

- Q4: San Antonio, TX (50 beds), Bangor, ME (50 beds), Avondale, AZ (60 beds)

Small Format Hospitals: New Growth Modality Starting 2027

Management unveiled a third expansion modality — small format hospitals — during the earnings call:

- 24-bed, single-story chassis on 2-2.5 acres

- Operates as a remote location under existing Medicare provider number (no separate certification needed)

- Hub-and-spoke strategy for large, growing markets like Dallas, Houston, Tampa

- First small format hospital opens in 2027

- "Dozens of potential locations" under consideration

CFO Doug Coltharp: "As we have ascended the learning curve with regard to our de novos... it's helped us kind of crack the code on this 24-bed prototype."

This approach solves for markets where existing hospitals can't physically expand, and leverages the host hospital's management team and marketing resources for favorable returns.

Balance Sheet Remains Strong

Net leverage of 1.9x at year-end 2025, down from 2.2x a year ago.

Free Cash Flow Generation

Adjusted free cash flow reached $818M in 2025, up 18.5% from $690M in 2024, driven by higher EBITDA and improved working capital.

The company raised its quarterly dividend to $0.19 per share in October 2025 (from $0.17) and repurchased 1.47M shares for $158M in 2025. ~$332M remains under the buyback authorization.

Key Regulatory Developments

Review Choice Demonstration (RCD) Expands

RCD — CMS's pre-claim review program for inpatient rehabilitation facilities — is expanding in 2026.

Performance Update: EHC's Alabama hospitals achieved a 93% average affirmation rate under 100% pre-claim review as of January 30, 2026. Pennsylvania IRF providers in the program averaged ~98%-99% affirmation rates.

CFO Doug Coltharp on Alabama MAC: "Palmetto is a pain in the butt in Alabama. They were a pain in the butt before RCD."

Despite the friction with Palmetto, EHC is expanding capacity in Alabama — filing CONs for expansions at 6 of 7 hospitals in the state.

TEAM Bundled Payment Model

The Transforming Episode Accountability Model (TEAM) launched January 2026, creating bundled payment episodes for certain surgical procedures at acute care hospitals.

EHC Impact:

- 89 EHC hospitals in TEAM markets (41 are joint ventures)

- Only ~2% of EHC total discharges fall within TEAM parameters

- Year 1 (2026) has no downside risk under the default track

Management noted EHC has experience with alternative payment models, having participated in BPCI Original (2014-2018), CJR (2016-2024), and BPCI-A (2018-2025).

Early Read on TEAM: After one month, EHC reported "no impact" of TEAM-associated diagnosis categories within impacted markets.

COO Pat Darcy on TEAM concerns: "We're not hearing a whole lot of chatter from [acute care hospitals] or our JV partners that they're going to handle patients differently. They remain very focused on quality, length of stay, capacity constraints, and readmissions — those are all elements of our value proposition."

Dialysis patients exempt: Patients on dialysis with end-stage renal disease are exempt from TEAM (4% of EHC volume). Through Tablo investments (~70% of hospitals covered), EHC could more than double this volume.

Q&A Highlights: Medicare Advantage Tensions and "Admit and Appeal" Strategy

Management disclosed significant issues with one unnamed national Medicare Advantage payer during Q&A, revealing a potential flashpoint for the industry:

CFO Doug Coltharp on MA denials: "We did experience some challenges with Medicare Advantage in the fourth quarter... with one national payer, where we saw the conversion rate drop not insignificantly. The referrals were actually up nicely, high single digits for the quarter. But the conversion rate was down significantly, and there's no reason for that."

Coltharp warning: "If this persists into next year, we may be inclined to name names."

The "Admit and Appeal" Response: EHC announced a new strategy to combat MA denials:

- For patients meeting Medicare coverage criteria, EHC will admit the patient and pursue all five levels of administrative appeal, through ALJ and federal district court if necessary

- Two major MA payers have conversion rates below 20% (vs. ~65% for Medicare fee-for-service)

- EHC believes these denials are "in direct contravention of Medicare coverage requirements"

VA Community Care Backfill: The VA program now represents 19% of managed care volume, with Q4 discharge growth of 25% and full-year 2025 growth of 22%. This provides a strategic buffer against MA pressure.

Payer Mix Update

Medicare remains the dominant payer, accounting for 66.5% of Q4 revenue (up from 65.6% YoY), while Medicare Advantage declined modestly to 15.7% from 16.5%.

Full Year 2025 Summary

Technology and Palantir Partnership

EHC extended and expanded its strategic relationship with Palantir, focusing on operational efficiency:

COO Pat Darcy: "People don't go to medical school or nursing school or therapy school to become great at documenting. We'll continue to evaluate opportunities to allow our clinicians to do what they do best, and that's take care of patients."

2026 Headwinds: Unit Closures

Management disclosed several unit closures/consolidations creating a ~70 bps headwind to 2026 discharge growth:

Management expects to mitigate 35-40 bps of the 70 bps headwind through volume recapture in adjacent markets.

The Bottom Line

Encompass Health delivered a clean beat-and-maintain quarter that showcased multiple positive developments. The 12% EPS beat reflects improved labor efficiency (contract labor at lowest since Q1 2021) and continued volume momentum, while 2026 guidance brackets consensus expectations. With 8 more hospitals in the pipeline, small-format hospitals starting 2027, a fortress balance sheet at 1.9x leverage, and demonstrated ability to navigate regulatory changes (93% RCD affirmation rate), EHC remains the dominant player in the fragmented $50B+ inpatient rehabilitation market.

Key takeaways from the call:

- Small format hospitals unlock a third growth modality — 24-bed satellites leveraging host hospital infrastructure

- "Admit and appeal" signals management will fight MA denials through all five levels of administrative appeal

- VA Community Care (19% of managed care, +22% YoY) provides a growing offset to MA pressure

- TEAM showing no impact after first month — "no chatter" from acute care partners about changing referral patterns

The key debates going forward:

- Medicare Advantage tension — Will the unnamed national payer adjust, or will EHC escalate to naming names?

- Texas/California RCD expansion — Can EHC maintain high affirmation rates as Novitas takes over in Texas (24 hospitals)?

- Small format hospital economics — Can management replicate de novo success with the 24-bed prototype at scale?

Encompass Health reports Q4 2025 earnings on February 6, 2026. Data sourced from company filings and S&P Global.